2025 Marks the Tipping Point for Humanoid Robots: AI and Robotics Set to Reshape Global Industry

In 2025, the humanoid robotics industry is reaching an inflection point, driven by AI foundation models, hardware innovation, and falling component costs. China is rapidly catching up across the value chain, and global players like Tesla are preparing for large-scale robot production. While regulatory and cost challenges remain, the sector is entering a critical growth phase with historic investment and innovation momentum.

Since early 2024, global capital markets have entered a frenzy over humanoid robotics. Behind this surge lies a profound technological revolution—“Robotics + AI”—now approaching a critical mass. Just seven years after Boston Dynamics’ Atlas robot achieved a backflip, Figure AI, backed by OpenAI, has demonstrated a humanoid robot capable of making coffee autonomously. With humanoid robots nearing mass production, this AI-powered revolution is set to reshape the future of global manufacturing.

Industry insiders are calling 2025 the “Year One of Humanoid Robot Mass Production.” This historic shift is driven by three key technological breakthroughs:

-

Advancements in bionic mechanical structures

-

AI foundation models integrated into robotic decision-making

-

Cost-effective innovation in core hardware components

Together, these breakthroughs are moving robots from research labs into real-world industrial and service applications.

AI Foundation Models Redefine the Robotic Brain

Large AI models are now powering the cognitive core of humanoid robots. Huawei’s 6G robot prototype integrates natural language comprehension, semantic environment mapping, and real-time path planning into a closed-loop system. Tesla has ported its Full Self-Driving (FSD) algorithms into its Optimus humanoid, using a hybrid VR training platform that allows robots to evolve autonomously through simulated operation. This fusion of virtual and real environments has increased robotic decision efficiency by more than 5 times compared to traditional rule-based programming.

China’s Hardware Innovation Cuts Costs, Enables Scale

China’s accelerated push for hardware self-reliance is driving down costs across the robotics supply chain. Domestic companies are rapidly closing the gap with global suppliers:

-

Greendrive Harmonic’s reducers now cost significantly less than imported counterparts.

-

Wuzhou New Spring’s planetary roller screws are already part of Tesla’s global supply chain.

-

Sensor manufacturers like Hanwei and Orbbec have made major breakthroughs in environmental perception and 3D vision.

This cycle of “technology breakthrough → cost reduction → market expansion” is laying the groundwork for mass deployment by 2025.

Upstream Components Lead with High-Efficiency Upgrades

Key upstream technologies are evolving quickly:

-

Inovance’s servo motors now reach 97% efficiency and are used in Tesla’s Optimus.

-

MOONS’ stepper motors with 0.9° precision dominate a significant portion of the global market.

-

Greendrive RV reducers now boast 20,000-hour lifespans.

-

Keli Sensing’s six-axis force sensors are already being used in robotic surgery.

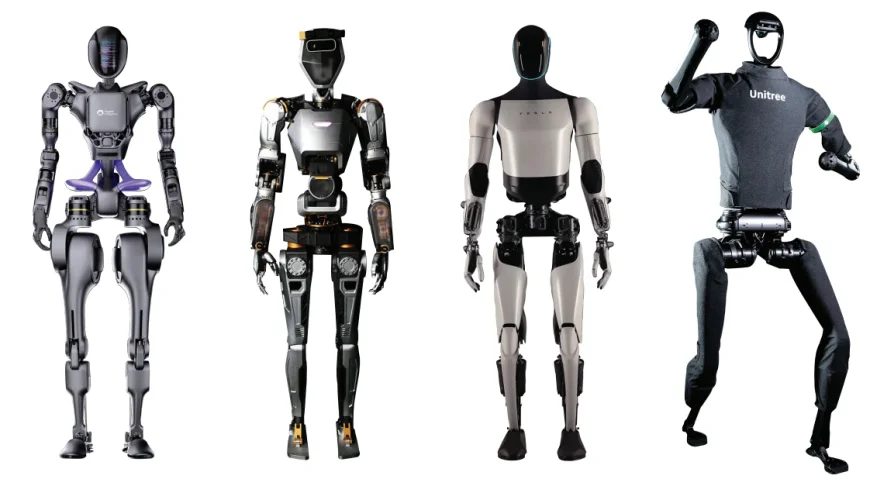

Midstream Manufacturers: Global Leaders Face Local Challengers

In the midstream, a clear competitive structure is forming. Global players like Tesla plan to produce 10,000 Optimus units in 2025 and scale to 100,000 per month by 2027. Meanwhile, Chinese firms are gaining traction: UBTECH’s Walker S1 targets home services, and Unitree’s G1 is suitable for a wide range of daily scenarios.

Dual-Track Applications: Industrial and Service Use Cases Expand

Use cases are diversifying quickly. Tesla’s Optimus is already assembling battery modules in its Gigafactories. In healthcare, the global market for surgical robots like the Da Vinci system is expected to reach $13.6 billion by 2025. Domestically, companies like Tinavi are making inroads with orthopedic surgical robots. On the service side, UBTECH’s home robots now perform over 200 tasks—from childcare to temperature monitoring.

Investment Outlook: Full-Chain Coverage with Focus on High-Barrier Segments

The first China Humanoid Robot Industry Conference forecasted that the domestic market will grow from ¥2.76 billion ($380 million) in 2024 to ¥300 billion ($41 billion) by 2035—a compound annual growth rate exceeding 50%.

Investment enthusiasm is covering the entire value chain:

-

Upstream: Fund inflows into component makers like Greendrive and Wuzhou.

-

Midstream: Core manufacturers such as Top Group and Shuanglin attract capital.

-

Downstream AI firms: Stocks like TRS and Orbbec surged over 50% in Q1 2025.

Challenges Ahead: Bottlenecks, Costs, and Regulation

Despite momentum, challenges remain. Mass production still faces technical and cost hurdles. Tesla’s Optimus is priced between $20,000–$30,000—too high for many households. Volume production is key to further price drops.

Ethical and legal questions are also emerging: Who is liable for surgical robot errors? How should service robots handle user data? These issues call for new regulatory frameworks.

A Historic Inflection Point for Robotics

The humanoid robotics boom of 2025 reflects not just technological maturity, but a convergence of policy support, capital investment, and real market demand. From AI brainpower to hardware independence, from industrial scale-up to household integration, the entire “Robotics + AI” value chain is entering a critical growth phase.

Investment will focus on companies with deep technical moats—whether in upstream core components, midstream form factor manufacturing, or downstream AI algorithm development. If trends hold, humanoid robots could follow the same explosive trajectory as electric vehicles, emerging as a new growth engine for the global economy.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0